If your business wants to take card payments, you must have a merchant account. To put it simply, this particular type of bank account makes it easier for businesses to process card transactions safely. The correct merchant services can facilitate payments and enhance cash flow whether you operate a physical store or an online store.

It can be difficult to choose the best merchant service provider, though. With so many options, it’s critical to compare merchant accounts in order to identify the best fit for your company. You can make an informed choice if you know how payment processing services operate.

Everything you need to know about creating a merchant account, how merchant payment processing operates, and how to choose the best provider is covered in this guide.

What is a Merchant Account?

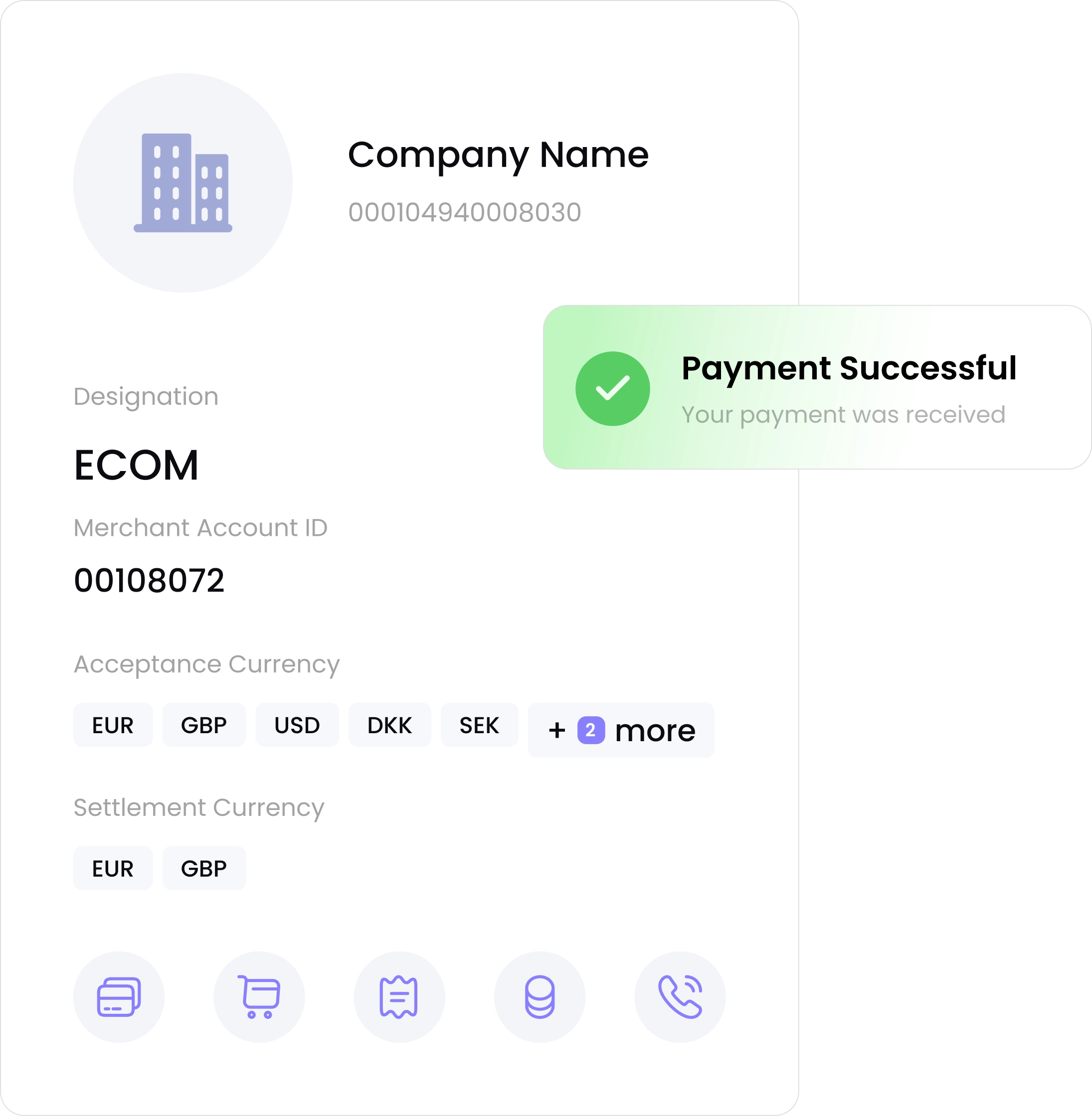

A merchant account is a type of bank account that lets businesses accept card payments. To put it simply, funds are transferred from the merchant account to the primary bank account when a customer uses a credit or debit card to make a payment.

Having an online merchant account is essential for e-commerce businesses in particular. They are unable to take consumer card payments without one.

Additionally, merchant accounts are linked to a Merchant Category Code (MCC), which classifies businesses based on the type of goods or services they provide. MCCs impact processing fees and chargeback risks, so understanding the right MCC for your business is important.

A merchant account can help you grow your business by allowing you to reach customers in the regions and currencies that the merchant account provider supports. It will also have features to prevent fraud and chargebacks, which can cause financial problems.

How Merchant Payment Processing Works

Businesses can manage transactions more effectively if they have a better understanding of how merchant payment processing operates. Here’s a quick summary:

- Customer makes a purchase – A customer enters their card details online or taps/swipes their card in-store.

- Authorisation – The merchant service provider sends the payment request to the customer’s bank.

- Approval or Decline – The bank checks the account and either approves or declines the payment.

- Settlement – If approved, the money goes into the merchant account before being transferred to the business bank account. It usually takes around 1–3 days.

Businesses should select reputable credit card payment processing merchant solutions to guarantee seamless transactions and reduce delays in receiving funds.

Since delays in merchant payment processing can affect cash flow, choosing a provider that offers fast payouts is essential. The right acquirer helps businesses maintain secure and uninterrupted transactions. Also, for businesses scaling globally, payment orchestration can streamline your entire payment flow by managing multiple gateways and providers.

For businesses working with third-party sales agents or payment resellers, an Independent Sales Organization (ISO), such as CardCorp, offers flexible payment solutions. Many businesses partner with an ISO to access tailored merchant services, reduce processing costs, and receive better customer support.

Setting Up a Merchant Account

Setting up a merchant account correctly ensures hassle-free payments. A merchant service provider with options for different industries can help businesses find the best fit.

Businesses should compare merchant accounts to determine the best balance between price, speed, and security before making a decision.

Are you new to merchant services? Here’s how to begin:

- Pick a merchant service provider – Compare providers to find the best rates and services.

- Apply for a merchant account – Fill out an application with details like turnover, business type, and expected transactions. Before applying, it’s helpful to know the essential steps for a smooth merchant account approval to avoid delays or rejections.

- Connect payment processing services – Link your payment processing system to your website or card machine.

- Start accepting payments – Once approved, you can begin taking card payments from customers.

CardCorp helps businesses open the right merchant accounts by matching them with acquirers that align with their needs.

How to Compare Merchant Accounts

Different merchant service providers provide different services. For this reason, it is essential to take into account the following factors:

- Transaction fees – Check the cost per transaction and any monthly fees.

- Contract terms – Some providers have long-term contracts, look for flexible deals.

- Customer support – Good support is important if payment issues arise.

- Security features – Check if the provider offers other security features in addition to PCI DSS compliance.

- Payment options – The provider should support online and mobile payments.

Ensuring PCI Compliance is crucial for preventing fraud and maintaining secure transactions. Businesses must meet these security standards to avoid penalties and protect customer data. Learn more about PCI Compliance and how to stay compliant with industry regulations.

By comparing credit card payment processing merchant services, businesses can get the best deal.

Furthermore, businesses should also look into the payment processing technology that a provider offers. Advanced payment systems with fraud protection and real-time reporting are available from certain merchant service providers.

Partnering with an Independent Sales Organization

Working with an Independent Sales Organization (ISO) can be very advantageous for companies looking for customized merchant services. ISOs provide specialized customer service, flexible payment options, and possibly reduced processing costs. They frequently have connections with several acquiring banks, giving companies in high-risk industries or those with special requirements more choices.

👉 Discover how partnering with an ISO can benefit your business

Common Merchant Account Problems and How to Avoid Them

Many businesses face problems with their merchant accounts. Here are a few typical problems and how to prevent them:

- High fees – Some providers have hidden fees. Read the contract carefully.

- Fraud & chargebacks – One of the biggest risks with merchant accounts is chargebacks – learn how to prevent fraudulent chargebacks and protect your revenue.

- Frozen or closed accounts – Some businesses face sudden account terminations because of high-risk transactions. Choosing a provider that understands your industry lowers this risk.

CardCorp helps businesses reduce the risk of sudden account freezes by ensuring they work with acquirers who understand their operations.

By working with a reliable merchant service provider can help businesses avoid these problems and keep payment processing smooth.

Conclusion

Businesses that wish to take credit or debit cards must have a merchant account. Whether you require an in-store solution or an online merchant account, the choice of merchant service provider has a significant impact on costs, security, and customer support.

Businesses can manage payments more effectively if they understand how merchant payment processing operates. Choose the best payment processing service for your needs by taking the time to compare merchant accounts.

Here are five warning signs to look out for when assessing your present processor because not all of them are made equal. Businesses can guarantee seamless payment processing, improved cash flow, and satisfied customers with a clever strategy.

By matching companies with acquirers who offer long-term dependability and a high-risk merchant account, CardCorp assists companies in maintaining steady payment processing.

With the right choices, businesses can enjoy simple, safe, and reliable payment processing for years to come.