Payment Links

Send payment links via email or SMS for a secure and convenient checkout with no integration.

Making a payment is the final step in a complex buyer journey; it’s the difference between intent and revenue, between lost opportunity and conversion

Whether your customer billing is driven by single events, subscriptions or instalment plans, preference matters. Understanding which purchase types and payment channels your customers prefer and which they feel comfortable with, will impact how many of them you manage to get over the line.

Take your payments to the next level with our billing orchestration suite

Build your products with as much detail as you like. Just point, click and configure, no code required. Add descriptions, images, item types and groupings.

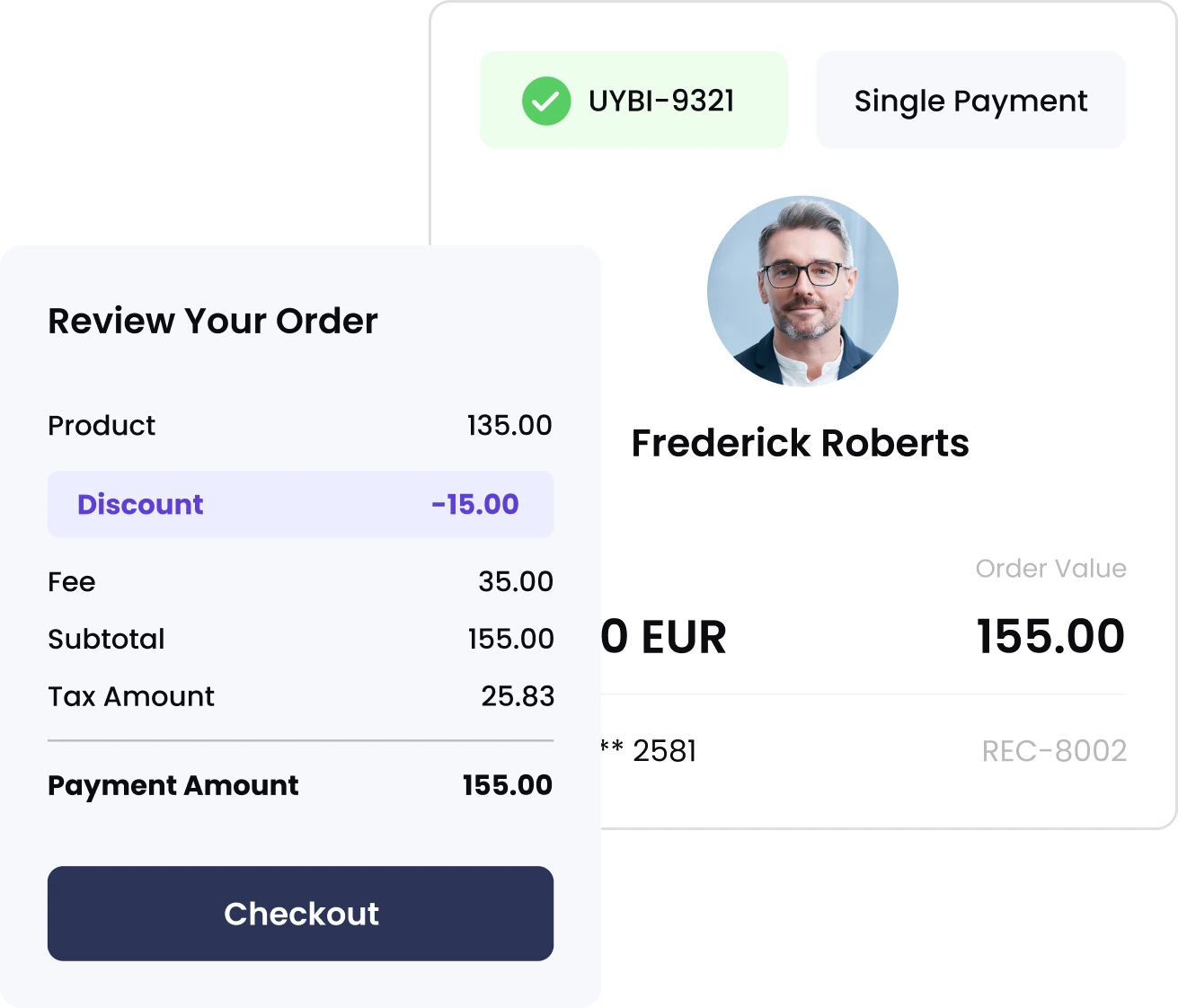

Configure pricing and add-ons like fees, discounts and taxes, and set up payment schedules with customisable billing cycles.

Accept orders for any purchase type

Beyond one-off payments, BillPro offers support for instalment purchases, metered billing, and subscription sales models, empowering businesses to explore customer preferences and experiment with different transaction scenarios.

Customised payment plans offer the opportunity to tailor pricing and payment schedules to individual customer needs. Whether it’s instalment payments, deferred payments, or milestone-based billing, BillPro provides the flexibility to create personalised payment schedules, enhancing customer satisfaction and loyalty.

For businesses with dynamic usage patterns, BillPro supports metered billing. This flexible model allows customers to pay based on their usage of a product or service, providing transparency and cost-effectiveness. Whether it’s metered usage, tiered pricing, or pay-as-you-go models, BillPro adapts to your billing needs.

Naturally, BillPro also supports subscription-based purchases. Subscriptions enable customers to opt for usage rather than ownership, making recurring payments at regular intervals to unlock access to products or services over a predefined period. BillPro seamlessly manages subscription renewals, ensuring a hassle-free experience for both merchants and customers.

We start with basics that just work, then checkbox more of your requirements in a single solution so you can focus on growth.

Send payment links via email or SMS for a secure and convenient checkout with no integration.

Accept over-the-phone orders and securely key payment information into our virtual terminal on any device.

Turn every device into a payment terminal. Accept face-to-face payments by presenting a QR code and letting your customer scan and pay on their mobile.

Generate orders directly from your website. The BillPro RESTful API supports order and customer creation from an external source.

Recover failed payments and prevent involuntary churn with smart auto-retry. Declined payments are reprocessed at configurable intervals to minimise revenue loss.

Manage scheduled and processed payments with complete flexibility. Skip or reschedule payments, retry declined payments, and merge any group of payments and process immediately or reschedule.

Provide a predictable customer experience and reduce your team’s workload with event-triggered email notifications and action prompts.

Stay compliant with scheme requirements by automatically generating and delivering card-on-file mandate agreements when card details are stored for recurring payment purchases.

Send payment link reminders automatically at configured intervals, track deliveries and viewed status.

Automatically send card update requests to customers and collect outstanding balances on successful update.

Instantly deliver payment confirmations for initial purchases, scheduled payments, declined payments and refunds.